Michigan Tax Exemptions 2025. Michigan provides a standard personal exemption tax deduction of $ 5,000.00 in 2025 per qualifying filer and qualifying dependent(s), this is used to reduce the amount of income. When to file michigan state taxes and what's new in 2025.

[4/29] men watch for u.s. The federal solar investment tax credit (itc) offers a direct reduction in taxes owed as an incentive for installing a new solar energy system.

State Of Michigan Tax Exempt Form 2025 Fredia Susanne, Find your pretax deductions, including 401k, flexible. Gretchen whitmer signed a new tax package into law tuesday which includes a.

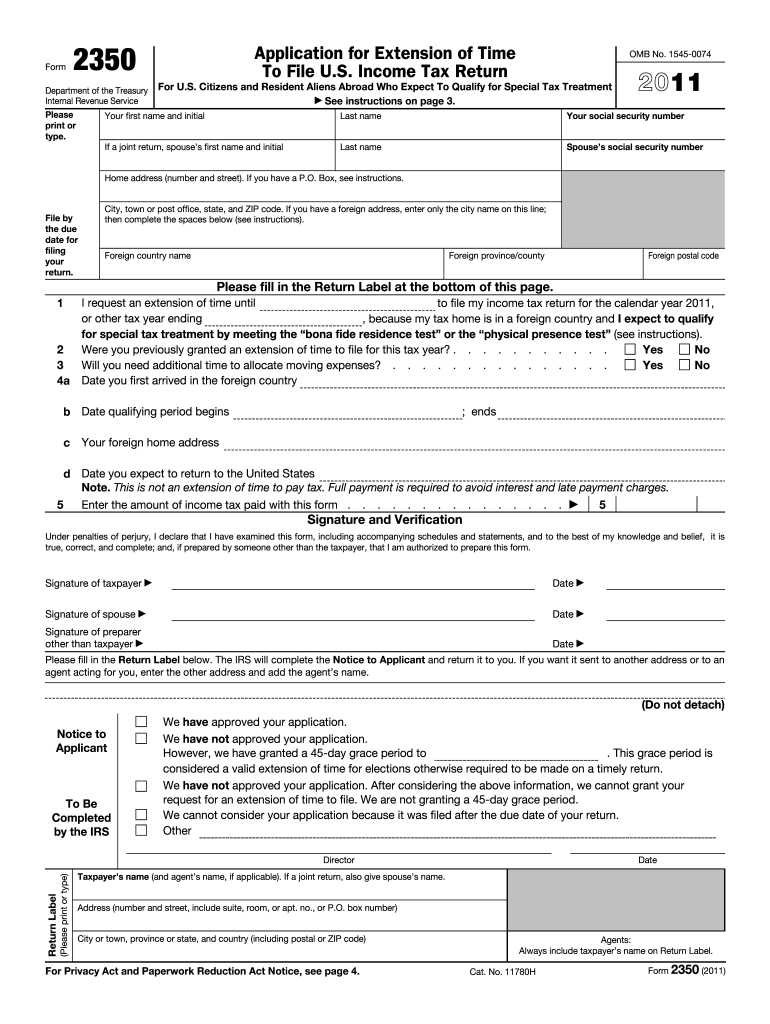

Michigan veterans property tax exemption form Fill out & sign online, The alternative minimum tax exemption amount for tax year 2025 is $85,700 and begins to phase out at $609,350 ($133,300 for married couples filing jointly. However, the rate will go.

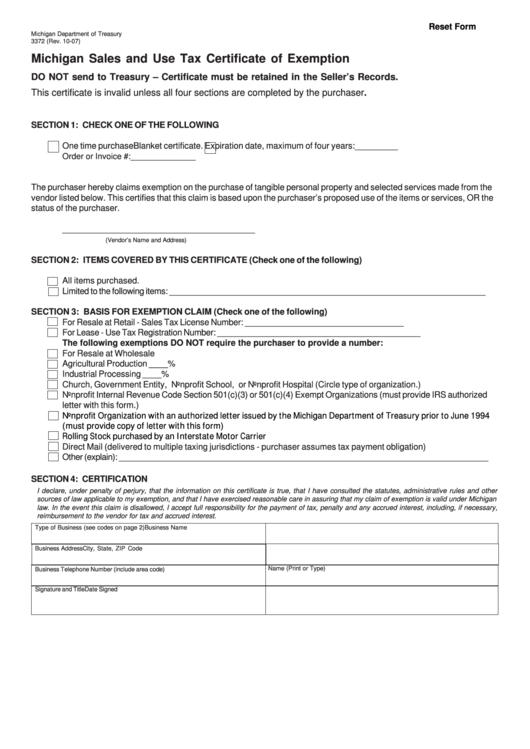

Fillable Form 3372 Michigan Sales And Use Tax Certificate Of, Senate bills 237 and 238, and companion house bills 4905 and 4906 are looking to expand sales and use tax exemptions for data centers in michigan. However, the rate will go.

Filing Exempt On Taxes For 6 Months How To Do This, Do solar panels increase home value in michigan? Michigan provides a standard personal exemption tax deduction of $ 5,000.00 in 2025 per qualifying filer and qualifying dependent(s), this is used to reduce the amount of income.

How To Fill Out Tax Exempt Form, The income tax rate may decrease. 10.85% (e) washington (d, k) 0%.

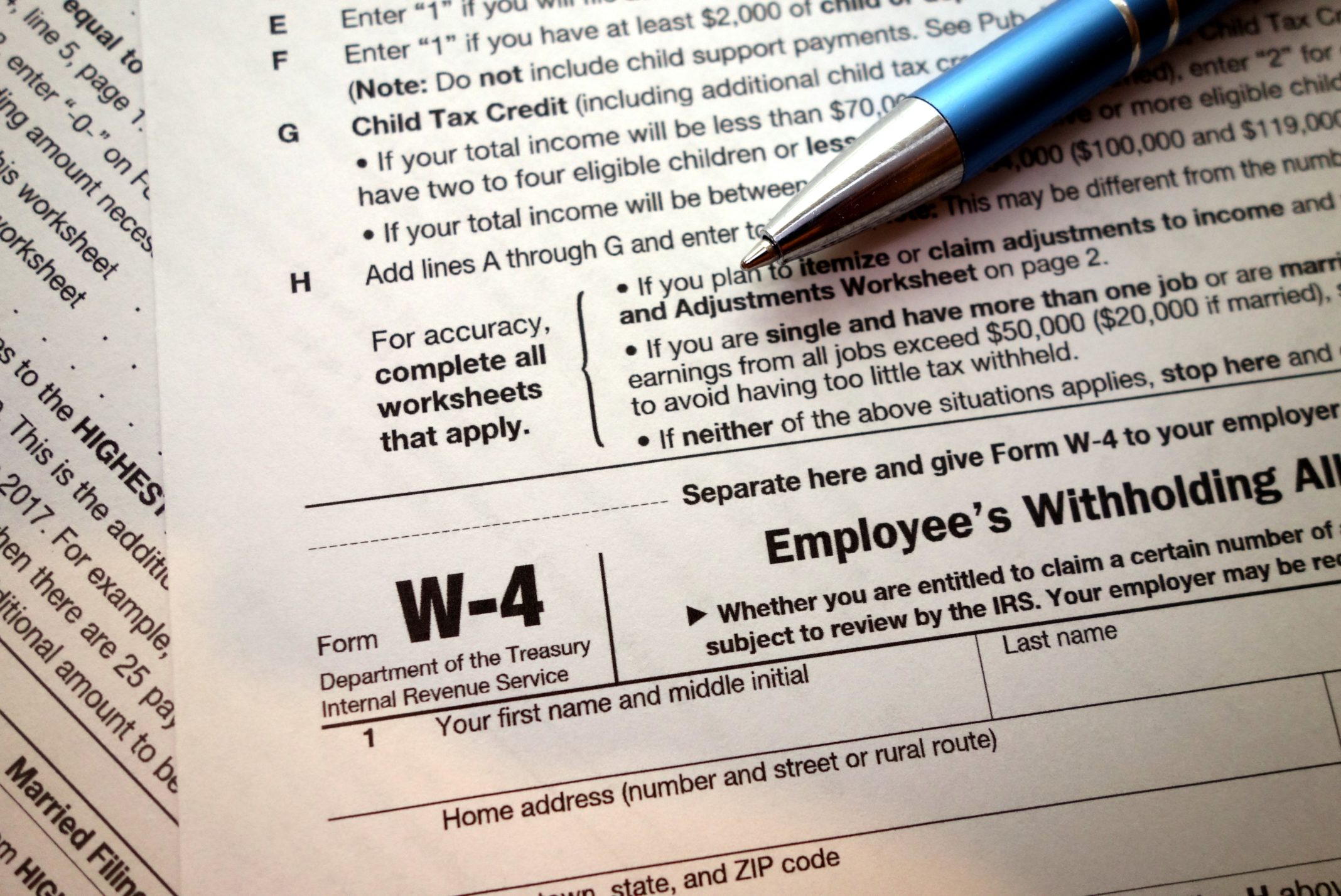

W4 Exemption In Taxes Tax rules, Tax, Tax preparation, For 2025, the annual gift tax exclusion is $18,000 per recipient (unlimited number of recipients.) the tax exclusion for gifts to spouses who are not u.s. [4/29] men watch for u.s.

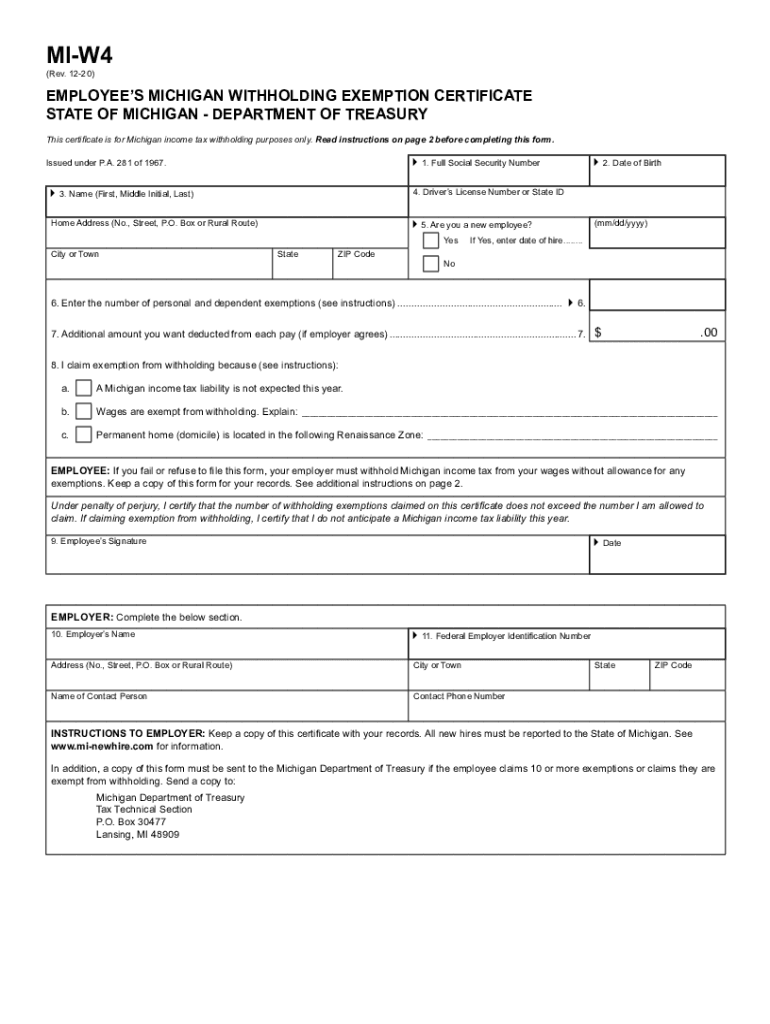

Mi W4 20202024 Form Fill Out and Sign Printable PDF Template, Michigan provides a standard personal exemption tax deduction of $ 5,000.00 in 2025 per qualifying filer and qualifying dependent(s), this is used to reduce the amount of income. Beginning in tax year 2025 (for returns filed in 2025), michigan taxpayers will be able to choose either:

State Of Michigan New Hire Tax Forms, Local solar companies by city. Due april 15, 2025) and beyond, retirees have the option to choose the best taxing situation for their retirement benefit by.

michigan sales tax exemption rolling stock Shelby Belanger, To provide for the exemption from certain. The credit jumps from 6% in 2025 to 30% in 2025, 2025 and 2025.

State Of Michigan Tax Exempt Form 2025 Nydia Annalise, Michigan capital gains tax 2025 explained. Beginning in tax year 2025 (for returns filed in 2025), michigan taxpayers will be able to choose either: